Texas Tax Id

Number

HERE IS WHAT TAX IDS YOU NEED TO START YOUR BUSINESS IN TEXAS

The State of

Texas has a:

1. State employer tax id number and a

2. A sales tax id number for taxable sales.

Texas law requires that all

starting

businesses, (including small business, internet business,

online business,

online web sites and home business), get a

business license and file DBA

and in most cases obtain a tax id number.

- All

businesses need a business license,

- All

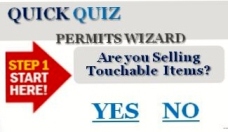

retailers and

wholesalers need a sales tax id number also called a seller's permit,

- All

employers need a federal tax id and state employer tax id

number, &

- All

businesses need an assumed business name certificate, also

called a DBA doing businesses as.